Canadians told to pay back CERB say eligibility requirements were unclear

Some Canadians say they were shocked and alarmed to learn they may have to pay back thousands of dollars in pandemic benefits after receiving letters from the Canada Revenue Agency last week suggesting they may not have qualified for the Canada emergency response benefit in the first place.

Government extends CERB, announces new COVID-19 ‘recovery’ financial benefits

The CRA is encouraging Canadians who got the letters to pay back the CERB by Dec. 31 so it does not negatively affect their tax returns.

Recipients of the letters have told CBC News they are being targeted because they used their gross income, including expenses. For a self-employed person that could include work-related cell phone bills or equipment needed to do their work.

Alison Griffiths says she was shocked to find that the CRA didn’t count those expenses towards her overall income.

“I was completely taken aback, and I thought, OK, this is a typo,” said Griffiths, an author of books on personal finance and a former Toronto Star financial columnist and CBC host.

“I immediately went back to the paperwork that I had copied and went back onto the internet. And I thought OK, this definitely is a mistake because I did not see the word ‘net’ anywhere.”

Griffiths, who considers herself financially literate, applied for the CERB for herself, her husband and her daughter, who recently graduated university and receives disability benefits.

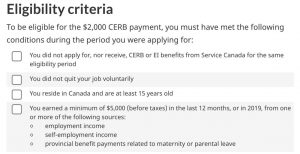

She said that the government of Canada website stated that in order to qualify for the $2,000 monthly payment, each person in her family had to have earned at least $5,000 in self-employment and/or employment income over the previous 12 months.

She said that, after receiving the letter from the CRA and combing through several pages and menus on the government of Canada website, she was able to find a mention of the net income measure.

The landing page detailing the eligibility requirements on Canada.ca still does not mention the word ‘net’ when referring to income.

Pedram Nasseh, a chartered professional accountant, said his office has been getting emails, text messages and phone calls from worried clients who have received the letters from the CRA telling them they do not qualify for the CERB they already have received.

“Panicked. People are panicked about that and they’re really, really worried, because people have spent the money to live,” he said. “They lost jobs and lost their business and they’re really panicked.”

Nasseh said many of those who applied for CERB assumed that gross income could be used in the application because no clear distinction was made between net and gross income.

“It was not clear at the time of applying, at the very beginning of this pandemic, when CERB was introduced,” he said.

‘It seems like the rules were changed last minute’

Tony Carlucci, a musician who also received the CRA letter, told CBC News that his industry has been shut down since the beginning of the pandemic and he needed the CERB to survive right from the outset.

“My heart was pounding and I felt like someone just punched me in the stomach. But ever since then, I still can’t wrap my head around the letter,” he said. “I’m perplexed, to be honest with you, and very upset.”

Unable to get a clear understanding from the government website, Carlucci sought expert advice and was told that the benefit probably would calculate his eligibility using the net income line from his previous tax return.

After receiving the CRA letter, Carlucci said he learned that two of his sources of income — a small union pension and some rental income — did not count toward his net income calculation.

“It seems like the rules were changed last minute. To me, that’s what it feels like,” he said.

Nasseh said the timing of the letters could not be worse; people have lost their jobs or have seen their incomes significantly reduced because of the pandemic and Christmas is only a few weeks away. On top of that, accountants are busy preparing for the year’s end.

He said the CRA should “wait for people to file their taxes” before sending the letters out. “At that time, if CRA is not happy, they could ask for the evidence,” he said.

“We’re in the middle of the pandemic and a lot of people are in need of the money and now they have to deal with this.”

The CRA told CBC News that it is taking an “educational approach” with the letters, explaining who qualifies and who does not based on their income. The agency said the request to pay the money back by December 31 is only a recommendation meant to avoid confusion on tax returns and should not be confused with a payment deadline.

Prime Minister Justin Trudeau told the House of Commons during question period Wednesday that the CERB and other emergency payments established swiftly in the early days of the pandemic are now being verified “on the back end,” and that people who made “good-faith mistakes” with regard to net income will not be penalized.

“The rules did not change, but we indicated to Canadians that we will work with them if people made good-faith mistakes,” he said.

It is not clear what Trudeau meant when he said Canadians who applied for the CERB using their gross income will not be penalized, but the CRA statement to CBC News suggests the benefit payments will have to be returned regardless.

“It is important to note that Canadians who applied for the CERB in good faith, and are later required to pay money back, will not be charged with penalties or interest,” the statement said.

“The CRA is sympathetic to the fact that, for some individuals, repayment of these amounts may have financial implications. For this reason, payment arrangement parameters have been expanded to give Canadians more time and flexibility to repay based on their ability to pay.”

Redes Sociais - Comentários